Some Of Custom Private Equity Asset Managers

Wiki Article

Things about Custom Private Equity Asset Managers

You have actually probably heard of the term private equity (PE): investing in business that are not openly traded. Approximately $11. 7 trillion in properties were handled by exclusive markets in 2022. PE companies look for possibilities to gain returns that are better than what can be achieved in public equity markets. However there may be a couple of things you do not recognize concerning the market.

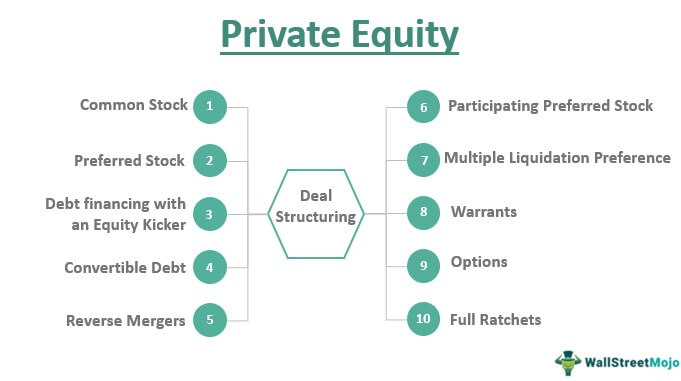

Companions at PE firms increase funds and manage the money to generate favorable returns for investors, commonly with an financial investment perspective of between four and seven years. Exclusive equity companies have a series of financial investment choices. Some are rigorous sponsors or passive financiers entirely dependent on administration to expand the business and generate returns.

Since the best gravitate toward the larger offers, the center market is a substantially underserved market. There are much more sellers than there are highly experienced and well-positioned financing experts with comprehensive purchaser networks and sources to handle a bargain. The returns of exclusive equity are usually seen after a couple of years.

Some Known Factual Statements About Custom Private Equity Asset Managers

Flying below the radar of big international corporations, a number of these little companies typically give higher-quality customer care and/or particular niche product or services that are not being supplied by the large empires (https://www.avitop.com/cs/members/cpequityamtx.aspx). Such advantages draw in the passion of private equity firms, as they have the understandings and savvy to manipulate such opportunities and take the company to the following level

A lot of managers at portfolio business are provided equity and reward payment structures that compensate them for hitting their monetary targets. Private equity opportunities are commonly out of reach for people that can not invest millions of dollars, yet they shouldn't be.

There are laws, such as limitations on the aggregate amount of money and on the variety of non-accredited financiers. The personal equity organization attracts several of the ideal and brightest in company America, including top entertainers from Lot of money 500 firms and elite monitoring consulting firms. Regulation firms can additionally be hiring grounds click this link for exclusive equity hires, as accounting and lawful abilities are necessary to complete bargains, and deals are very looked for after. https://businesslistingplus.com/profile/cpequityamtx/.

The 9-Second Trick For Custom Private Equity Asset Managers

One more drawback is the absence of liquidity; as soon as in a private equity transaction, it is challenging to leave or offer. There is an absence of flexibility. Private equity additionally features high charges. With funds under administration already in the trillions, private equity companies have actually ended up being eye-catching financial investment automobiles for wealthy people and establishments.

For years, the attributes of exclusive equity have actually made the possession class an attractive suggestion for those who could get involved. Now that access to private equity is opening up to even more individual capitalists, the untapped potential is ending up being a truth. So the inquiry to think about is: why should you invest? We'll begin with the major disagreements for spending in exclusive equity: How and why personal equity returns have actually historically been greater than other possessions on a variety of degrees, How including private equity in a portfolio influences the risk-return account, by assisting to branch out versus market and intermittent risk, After that, we will outline some key considerations and risks for personal equity investors.

When it pertains to introducing a new asset right into a profile, one of the most standard factor to consider is the risk-return account of that possession. Historically, personal equity has displayed returns similar to that of Arising Market Equities and greater than all other traditional possession classes. Its relatively reduced volatility paired with its high returns creates a compelling risk-return account.

The Facts About Custom Private Equity Asset Managers Uncovered

In truth, exclusive equity fund quartiles have the largest variety of returns across all different asset classes - as you can see below. Methodology: Interior rate of return (IRR) spreads out calculated for funds within classic years independently and then averaged out. Mean IRR was computed bytaking the average of the average IRR for funds within each vintage year.

The effect of including private equity right into a portfolio is - as always - dependent on the portfolio itself. A Pantheon research from 2015 recommended that consisting of personal equity in a portfolio of pure public equity can unlock 3.

On the other hand, the most effective private equity companies have access to an also bigger pool of unidentified opportunities that do not face the same examination, in addition to the resources to perform due diligence on them and recognize which deserve buying (TX Trusted Private Equity Company). Spending at the first stage means higher threat, but also for the companies that do be successful, the fund gain from higher returns

The Single Strategy To Use For Custom Private Equity Asset Managers

Both public and personal equity fund supervisors devote to spending a percentage of the fund but there remains a well-trodden concern with lining up rate of interests for public equity fund management: the 'principal-agent trouble'. When a capitalist (the 'principal') works with a public fund manager to take control of their resources (as an 'representative') they delegate control to the supervisor while retaining ownership of the possessions.

When it comes to personal equity, the General Partner doesn't just gain a monitoring cost. They likewise make a percentage of the fund's revenues in the type of "lug" (usually 20%). This guarantees that the interests of the supervisor are lined up with those of the financiers. Personal equity funds additionally alleviate one more kind of principal-agent issue.

A public equity capitalist ultimately wants one point - for the administration to raise the stock price and/or pay out dividends. The financier has little to no control over the decision. We revealed over the number of personal equity strategies - specifically majority acquistions - take control of the operating of the company, ensuring that the lasting worth of the company precedes, rising the roi over the life of the fund.

Report this wiki page